Glimpse on Spot and Derivative Market of Electricity and Nepal’s Hydropower.

Written by: Ranju Pandey, MBA Class of 2024

Energy plays a vital role in a country’s economic development. Nepal abundantly blessed with various renewable resources like hydropower, solar energy, biogas, and biomass can achieve prosperity both economically and socially. Further, with a significant opportunities for the regional electricity market as the country has been surrounded by big powerhouses like China and India. It has huge possibilities for regional trading of renewable energy. The present total Installed capacity of power is 3157 MW in Nepal. With 95% hydropower generation, the energy mix in the Integrated Nepal Power System makes the country a surplus of electricity during the wet season when the water in the river is very high and a shortage during the dry season when the discharge in the river is minimal. Hence, to address the surplus generation during the wet season and shortage of power during the dry season, trading in the region plays a very vital role in balancing the demand and supply of the country. Nepal has been importing power during the dry season power deficit in the market during the dry season when the demand is high leaving NEA at risk of interrupting the supply to its customers. Likewise, uncertainty about clearing a bid during the wet season when the power production is high and Nepal is in the position to export the power in the regional market, as the Hydropower plant has to compete with the cheap coal power plant resulting in financial loss and uncertainty of return on investment. Hence, to tackle the mentioned financial risks, the Electricity Derivative market can be one of the best options as derivatives markets can be used to hedge against price fluctuations in electricity spot markets. Similarly, the uncertainty of power sale can be avoided by selling or buying the electricity through a derivative market for the future time period that secures the price and the amount that can be sold in the market in the future. In a nutshell, the Electricity Derivative market can be a useful mechanism for the development of hydropower in Nepal in the future.

Keyword: Spot market, derivative Market, electricity, hydropower, Nepal

Energy plays a vital role in the socio-economic development of developing countries. In countries where biomass is the main energy source for millions of people, mostly living in poverty, clean renewable energy is the engine for development. As per Agenda 30, out of the 17 Sustainable Development global goals, goal no.7 “affordable and clean energy to all” is one of the major goals. This brings new levels of prosperity both economically, socially and environmentally to the country (ADB, 2020). Renewable energy is a clean form of energy that can help developing countries achieve higher GDPs. Hence, there is a need to promote the large-scale deployment of renewable energies for power development that ultimately leads to the overall sustainable development of the country. Like other developing countries, Nepal still depends heavily on firewood for cooking in rural areas, kerosene for lighting, and LPG gases in urban areas. Nepal's government and utilities have been working to supply reliable and safe regular electricity to all over the country.

The government has been giving priority to economic development through the construction of the infrastructure (e.g., National Grid extension, development of the big hydropower project, roads, railway tracks, etc.). Hence, this ensures the country’s economic growth and thrives and fosters happiness and prosperity nationwide. In this regard, Nepal is abundantly blessed with various renewable resources like hydropower, solar energy, biogas, and biomass. Study shows that Nepal receives sunlight for approximately 8 hours a day for 300 days per year, and the country’s abundance of over 6000 rivers and steep topography offer significant hydropower potential (ADB, 2020). In addition to that, Nepal is landlocked by big powerhouses like China and India with a large emerging economy. Therefore, this offers significant opportunities for the regional electricity market. The deployment of renewables will make the country self-sustainable in clean energy, improve the livelihood of the people, and increase employment opportunities.

Nepal’s perennial rivers and steep topography make it highly conducive for the development of hydroelectric projects. It has approximately 42,000 MW of economically feasible hydropower potential. Hence, to harness the potential of hydropower sources, to expand the electrification within the country, and to export the power to the neighboring countries, the GoN developed the Hydropower Policy in 2001 (GON, 2001). This policy also opens the door for private sector investment in the sector of hydropower development. The private investors are allowed to build and operate hydropower projects in Nepal under the build–own–operate–transfer (BOOT) model. Realizing a strong demand for power in domestic as well as in neighboring countries, there are several run-of-river hydropower projects owned by private companies. The government has provided licenses to generate electricity to more than 200 private companies.

According to the whitepaper published by the Ministry of Energy, Water Resources and Irrigation(MOEWRI), the energy mix of the system has been clearly defined as 30 to 35 % of the energy mix is Run-off River Hydro Power plant. Similarly, 25-30 % (GoN, 2018) from the Peaking Run of River Plant and 30-35 from the Storage Hydro Power Project. Furthermore 5-10 % from the other renewable resources (solar, wind, biogas etc.). Similarly, the country has a highly ambitious plan to increase the per capita consumption to 700 kWh where the basic consumption by 2024 is 400 kWh (NEA, 2024). With the huge investment in hydropower projects and few solar projects in the (Public Private Partnership) PPP model, the power sector is ready for reform. Furthermore, with the establishment of the Nepal Electricity Regulation Commission in 2019 (GoN, 2017), the Government of Nepal is on the verge of reforming the sector with the segregation of the transmission, generation, and distribution sectors along with the formation of the power trading company. In addition, regional trading mainly in the power market of India, and bilateral trading with Bangladesh is the government’s major priority.

Moreover, linking energy as an extremely important component in the development process for providing economic and social benefits to the people(Chaudhary, 2024). The government has drafted the white paper with a plan to generate 28500 MW by 2035, with13500 MW for domestic consumption purposes and 15000MW for cross border trading. Rapid power sector expansion is one of the major agenda of the Government for a prosperous and happy Nepal. Furthermore, the Nepal Government has signed long-term power agreements with India to supply 10,000 MW of power to India (Sharma, 2024). As per NEA (2024), the total Installed capacity of power is 3157 MW with 95% hydropower generation. Furthermore, 65% of the scheme has been dominated by run-of-the-river (RoR) hydropower plants. Figure 1 shows the percentage of the power generated by NEA, NEA subsidiaries and Independent Power Plants (IPPs). Moreover, 10.301 GW generating plants had done PPA to generate the power. Similarly, around 99% of the total Nepal’s total population has access to electricity (NEA, 2024).

Since 65% of the operating power plants are ROR plants and most of the hydropower that has conducted the Power Purchase Agreement are RoR plants. Run of the River power plants in Nepal face challenges in meeting the growing demand for electricity during the dry season, where discharge in the river is reduced to 1/3rd of its capacity. This gives the country a surplus of electricity during the wet season and a shortage during the dry season when the discharge in the river is minimal. Hence, to address the surplus generation during the wet season and shortage of power during the dry season, trading in the region is very essential. Hence regional trading has played and shall play a very vital role in balancing the demand and supply of the country. This paper aims to discuss about spot and derivative market of electricity and its advantages in Nepal’s hydropower sector. The secondary data is reviewed for the research paper.

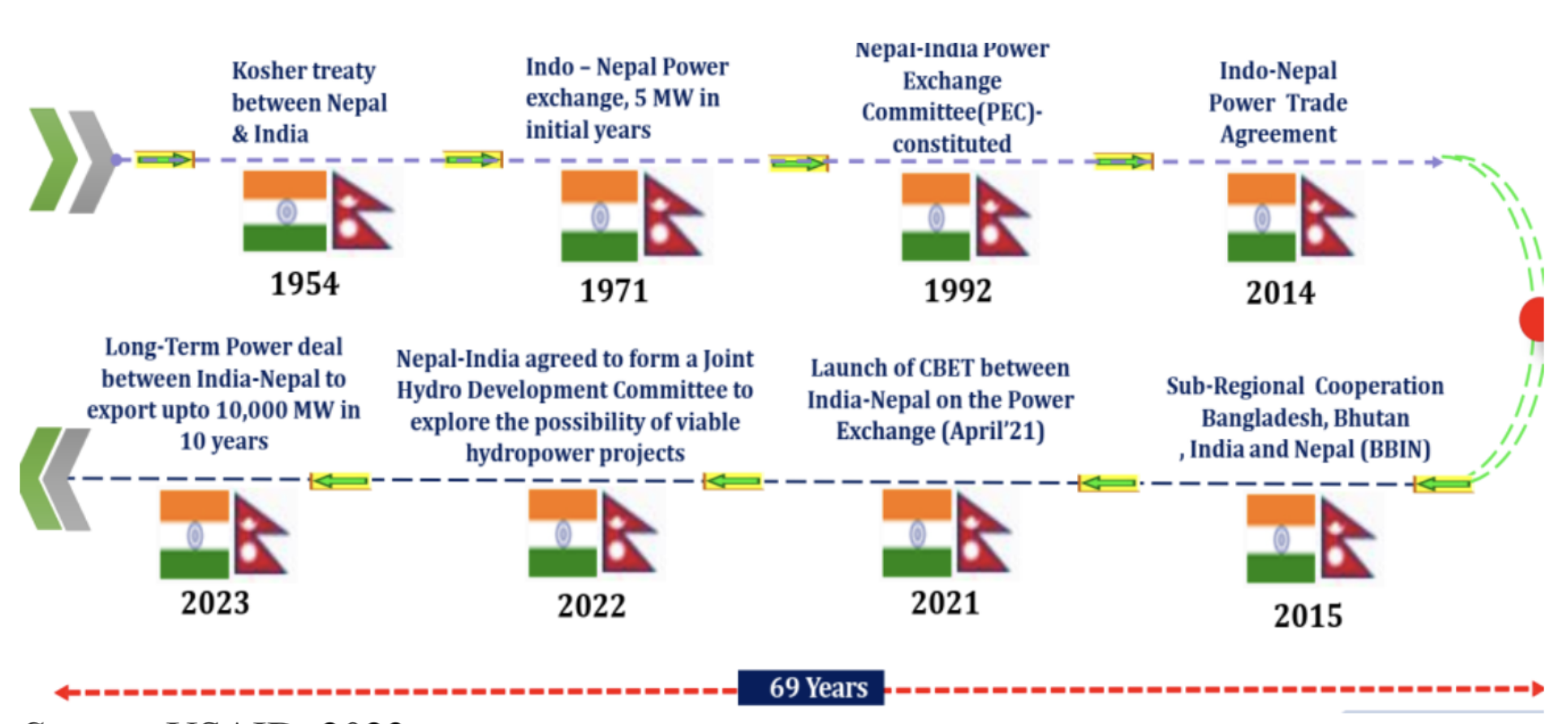

Export-Import History of Nepal

Nepal and India have the energy cooperating with the Koshi project agreement since 1954 AD (Vasani Harsh, 2023). Figure 2 shows the power trading cooperation and the milestones of various agreements between Nepal and India over the past 69 years in the energy sector. Till now, Nepal and India have 12 numbers of interconnections to exchange power between two countries through various lines operating at various voltage levels from 33 kV to 400 kV as one is Dhalkebar- Muzaffarpur. At present Nepal is exporting about 690.5 MW of power from different generators to India Exchange Market.

As mentioned above, Nepal's electricity mix has more than 95% hydropower plants. Nepal, which relies heavily on hydropower, experiences seasonal variations in power generation. Nepal has been importing power from India to address the demand-supply gap in the country, especially in dry season months.

In India, post electricity market reform, the Indian Exchange Market (IEX) started operation in 2008. Nepal became the first South Asian country to join this exchange platform on April 17, 2021. However, the actual commercial operation in IEX started on May 1, 2021, after Nepal Electricity Authority (NEA) gained approval from the Designated Authority (DA) of India, i.e., Member (Power System), Central Electricity Authority (CEA) for import of power up to 590 MW from India from Day- Ahead Market (DAM) and Real Time Market( RTM) of IEX (NEA, 2022) and through Bilateral mode. A total of 556.67 MW has been sold through the Indian Exchange market in DAM and RTM. Similarly, around 384 MW from different 14 projects has been sold through medium-term Power Sale Agreements to Bihar and Haryana states of India. In total Nepal at present has been exporting 941 MW of power from different 28 projects.

Since, Nepal has been regularly bidding in the electricity spot market since 2021, where the price of the electricity has been determined by the market itself. Nepal has been regularly importing power from the Electricity Exchange Market in Day Ahead Market and Real Time Market. The deregulation and competition in the wholesale market in India have resulted in lower market-driven prices. However, there is greater price volatility observed in the market. Volatility in the electricity market has caused significant risk to the wholesale market participant. Hence, the generators face the risk of low prices which have an impact on earnings. Similarly, Discoms/ Consumers face a complementary risk of price, and even at the high price electricity is scarce. (Budathoki, 2021). Hence, there is uncertainty about energy availability in the market even at high prices and low prices during the surplus time.

Consequently, as a purchaser, the risk of power unavailability is inherently borne by NEA. This results in a Power deficit in the market. Similarly, during the wet season, there is always uncertainty of clearing a bid and has to compete with the cheap coal power plant resulting in financial loss and uncertainty of return on investment. Therefore, NEA refrains from entering into Power Purchase Agreements due to stagnant domestic demand and market uncertainty. Likewise, in the dry season, there is uncertainty regarding obtaining power from the market when demand is high, leading to the risk of NEA interrupting the supply. Therefore, the sole organization for power trade like NEA can manage the exposure to volatility by entering financial contracts that lock in firm prices for the electricity they intend to produce or buy in the future. Derivative in the market plays an important role in mitigating the financial risk and the resources deficit risk.

Spot Market A spot market is a public financial market in which financial instruments or commodities are traded for immediate delivery. The transactions are usually settled "on the spot," meaning within a very short period, typically within a couple of days .

Key Characteristics of Spot Markets

Electricity Markets

A market is a mechanism for matching supply and demand for a commodity through the discovery of an equilibrium price. (Awasthy, N.D). In a spot market, purchasers take immediate possession of goods at the point of sale (Fernando, 2022). Whereas, in the derivatives markets, the investors purchase the right to take possession at a future date (Fernando, 2022).

Derivatives Markets

The basic principle of hedging with derivatives involves taking opposite positions in the spot and derivative markets. The price in the derivative market depends upon those in the spot market. Hence, opposition positions in the two would result in the offsetting of gains and losses. This led stability to in price and achieved the objective of hedging.

However, hedging with derivatives is different from managing risk through diversification. The diversification eliminates unsymmetrical risk, derivative would deal with systemic risk. Price protection with derivatives is different from insurance. Insurance covers event risk while derivatives hedge against changes in the price of the assets.

Hedging with derivatives is a tactical decision that is economical, reversible and quick which is in contrast to strategic risk management. Hence, the derivative market is a financial market where financial instruments known as derivatives are traded. Derivatives derive their value from an underlying asset, index, or rate, and their purpose is to manage or speculate on risk.

Basic derivatives are forward contracts, futures, options, and swaps. These financial contracts include options, futures, forwards, and swaps, providing investors and businesses with a toolset to hedge against market fluctuations, diversify portfolios, or engage in speculative activities.

Derivatives can be based on various underlying assets, such as commodities, currencies, interest rates, stocks, or even weather conditions. The market is characterized by its complexity and the use of financial instruments that derive their value from other assets. There are mainly three different participants in the derivatives markets.

Derivatives perform several economic functions such as enabling price discovery, facilitating the transfer of risk and providing leverage. These further enable efficient portfolio management, asset allocation and faster and more efficient dissemination of information, removing imperfections in the markets.

One of the criticisms of derivatives is that they encourage excessive speculation leading to excessive volatility. This causes volatility in the prices of the underlying asset in the physical markets. Leveraging also leads to increased bankruptcies, warranting an increased need for monitoring and regulation.

In wholesome, derivatives are contracts that derive their value from the price of an underlying asset. The underlying asset can be commodities (wheat, rice, silver, tin, etc) financial products (stocks, currencies, etc) or hypothetical assets (interest rates, indices, etc). Forwards and futures are the most common forms of derivatives that can exist on a variety of underlying assets. These are contracts that specify the price of an asset today but are settled These are standardized contracts traded on organized exchanges. The terms, including contract size, expiration date, and other specifications, are predetermined by the exchange. This standardization allows for easier trading and flow of liquidity.

Electricity Derivatives Market

The electricity derivatives market is a specialized segment within the broader derivatives market, focusing on contracts related to the buying and selling of electricity. This market has gained significance as the energy sector has evolved and diversified, and there's a need for market participants to manage the risks associated with electricity price volatility. The participants in the derivatives market include electricity producers, distributors, and consumers. Similarly, traders and investors are also engaged in electricity derivatives for speculative purposes. They attempted to make a profit from anticipated movements in electricity prices. In electricity derivatives markets, derivatives are often linked to the spot price in the electricity market.

Hence, having a derivatives market for electricity often tends to help in lowering price volatility over time and having a strong and liquid derivatives market for electricity that allows for better price discovery and transparency. This also makes the power business attractive for the physical value chain participants to engage in derivative instruments as a part of their price risk management program to help both mitigate the impact of price volatility on their profitability and serve as an avenue to optimize the cost of long-term Power Purchase Agreements (PPA) contracts. The derivatives are used to hedge against price fluctuations in electricity markets. As mentioned, this helps them to mitigate the impact of unexpected changes in prices. Traders and investors may engage in electricity derivatives for speculative purposes, attempting to profit from anticipated movements in electricity prices.

In most of the large global power markets, there is a well–developed liquid and competitive power market comprising physical contracts and financial derivatives. It helps all the participating traders to sell and buy power at a competitive rate. Most global commodity derivatives exchanges offer futures and options as the derivative instruments for electricity, that are linked to the underlying physical marketplace or exchange. For example, electricity derivatives shall have spot prices quoted in the physical exchanges as the underlying asset.

Therefore, Electricity derivative markets are an important avenue for companies seeking to hedge their underlying electricity exposures, enabling sufficient liquidity in the marketplace through market making and providing financing for undertaking derivatives transactions. And it is equally important for the success of an electricity derivative market. Overall, these markets play a crucial role in providing stability to electricity prices and managing risk for various stakeholders in the energy industry.

Various types of derivatives are traded in the electricity derivatives markets. Based on the assessment of the need, liquidity transparency in price discovery and settlement mechanisms, the various derivatives such as futures, options, and in some cases swaps are mostly used. Various types of derivatives are traded in the market to manage risk, speculate on price movements, and facilitate trading activities. Therefore, the basic principle of hedging with derivatives is concerned with taking opposite positions in the spot markets and derivative markets. The price in the derivative market depends upon those in the spot market. Hence, opposition positions in the two would result in the offsetting of gains and losses. This led stability to in price and achieved the objective of hedging.

The spot market along with a future derivative electricity market often tends to help in lowering price volatility over time and having a strong and liquid derivatives market for electricity allows for better price discovery and transparency. This also makes the power business attractive for the physical value chain participants to engage in derivative instruments as a part of their price risk management program to help both mitigate the impact of price volatility on their profitability and serve as an avenue to optimize the cost of long-term PPA contracts. The derivatives are used to hedge against price fluctuations risk in electricity markets. As mentioned, this helps them to mitigate the impact of unexpected changes in prices. Traders and investors may engage in electricity derivatives for speculative purposes, attempting to profit from anticipated movements in electricity prices. Similarly, during the construction of the projects, the market ensures that the power will be sold in the market which minimizes the various risks associated with the development of Hydropower.

Likewise, in the dry season, there is uncertainty regarding obtaining power from the market when demand is high, leading to the risk of NEA interrupting the supply.Therefore, organizations like NEA can manage the exposure to volatility by entering financial contracts that lock in firm prices for the electricity they intend to produce or buy in the future. Derivative in the market plays an important role in mitigating the financial risk and the resources defected. Hence, having a derivative market for electricity often tends to help in lowering price volatility over time and having a strong and liquid derivatives market for electricity allows for better price discovery and transparency. This also makes the power business attractive for the physical value chain participants to engage in derivative instruments as a part of their price risk management program to help both mitigate the impact of price volatility on their profitability and serve as an avenue to optimize the cost of long-term PPA contracts.

The derivatives are used to hedge against price fluctuations in electricity markets. As mentioned, this helps them to mitigate the impact of unexpected changes in prices. Traders and investors may engage in electricity derivatives for speculative purposes, attempting to profit from anticipated movements in electricity prices. During the construction of the projects, the market ensures that the power will be sold in the market which minimizes the various risks (financial risk, construction risk, etc) associated with the development of Hydropower. Similarly, Electricity spot prices are volatile as it is affected by various external factors. Hence, due to the consequence of the unique physical attributes of electricity production and distribution, the electricity spot market is volatile. Therefore to avoid these situation electricity derivatives play an important role in establishing price signals (Deng, S.J & Oren, S.S. (2006).

Since India is on the verge of establishing the Electricity Derivative market, and Nepal has been importing and exporting power through the Power spot market (Power exchange market), the experience in the Power Spot market provides Nepal with opportunities to take advantage of the derivative market and minimize the financial risk securing the position of position in the derivative market.

Overall, the use of the electricity derivatives market with the experience of the Power spot market can help the development of hydropower plants with greater stability, predictability, and flexibility in managing their construction and operations. This will definitely impact on financial performance which ultimately contributes to the sustainability and profitability of renewable energy assets. (MCX, 2021).